Did you know a whopping 78% of Americans struggle from one paycheck to the next? This fact shows how crucial financial freedom is. It tells us we must take control of our money. If you’re done being stuck in this cycle and want to grow your wealth, the ultimate financial independence flowchart can lead the way.

Key Takeaways:

- 78% of Americans are living paycheck to paycheck.

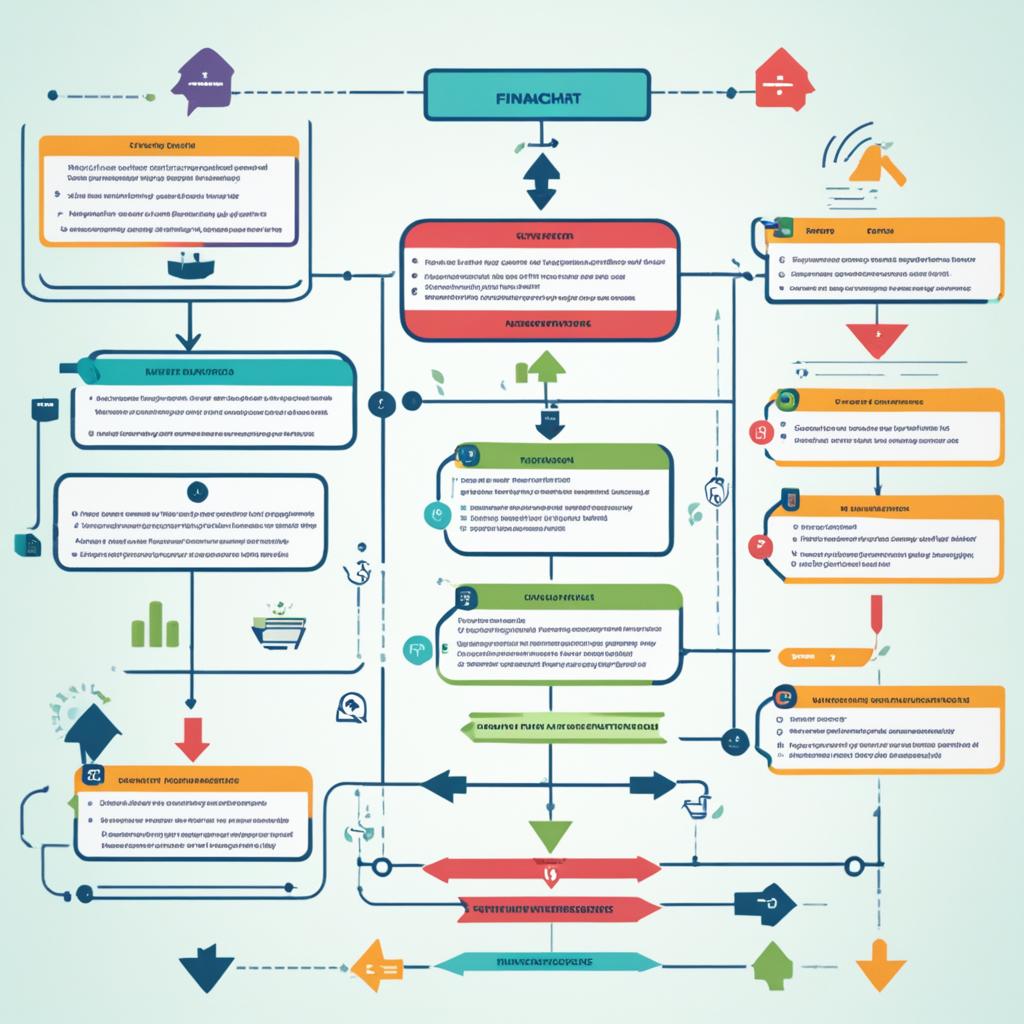

- The best financial independence flowchart is a comprehensive guide to help you achieve financial freedom.

- By following the step-by-step roadmap, you can navigate your way to financial independence and create a secure and prosperous future.

- Financial independence requires commitment and dedication, but with the right tools and resources, you can achieve your goals and live a life of financial abundance.

- Start your financial independence journey today and take control of your financial future.

Introduction & First Steps

Today, many of us want to achieve financial independence. The roadmap to financial independence can help make this goal a reality. By using wealth building strategies and learning to manage money, you can take charge of your finances. This leads to a secure and prosperous future.

Financial independence means having the freedom to live your way. It lets you make choices based on your values and goals, free from money worries. Whether you dream of starting a business, seeing the world, or retiring early, financial independence can make these dreams come true.

Why Financial Independence Matters

Financial independence offers more than just security. It brings peace of mind, knowing you’re financially stable. It reduces stress and lets you control your finances, not the other way around.

“Financial independence is the ability to live from the income of your own personal resources.”

– Robert Kiyosaki

The journey to financial freedom starts with key first steps. These steps lay the foundation for success. Here’s how to begin:

- Evaluate Your Financial Situation: Look closely at your income, expenses, and overall financial health. This helps you see where you stand and what you can improve.

- Set Clear Goals: Decide what financial independence means to you and set your financial goals. Whether that’s paying off debts, saving for retirement, or earning passive income, clear goals motivate you.

- Create a Budget: Make a budget that matches your goals. This helps you manage income and expenses, track progress, and make needed adjustments. It keeps you moving towards financial independence.

Let’s now look at some effective money management tips and strategies for building wealth. These will guide you to financial freedom.

| Wealth Building Strategies | Money Management Tips |

|---|---|

| 1. Diversify Your Income Streams | 1. Establish an Emergency Fund |

| 2. Invest Wisely for Long-Term Growth | 2. Automate Your Savings |

| 3. Leverage the Power of Compounding | 3. Minimize Debt and Interest Payments |

| 4. Take Advantage of Tax-Saving Opportunities | 4. Track Your Expenses and Identify Areas for Savings |

| 5. Continuously Educate Yourself About Personal Finance | 5. Practice Mindful Spending and Avoid Impulse Purchases |

I’ll show you how to understand your financial status by managing your balances and transactions. This is key to seeing how you spend your money. I will also share tips to help you budget better. This way, you can manage your money wisely.

Knowing your financial health is very important. By keeping track of your balances and transactions, you can check your income, expenses, and savings. Make sure to gather information from your bank and credit card statements, and any other accounts you have.

Having all your financial info in one place offers a complete view of your money situation. You can spot where you might be spending too much. This helps you make smart choices to improve your finances.

Next, it’s time to organize this data. You can use a spreadsheet in Microsoft Excel or Google Sheets. Or you could use apps that sort your transactions for you.

When organizing, think about putting them into categories. For example, label them as housing, transportation, groceries, or entertainment. This shows you where your money goes. It helps in finding where you might need to spend less.

Budgeting techniques are important for financial health. A good budget helps you manage your money, keep spending in check, and save for goals.

Here are some budgeting techniques to help you get started:

- The 50/30/20 Rule: Use 50% of your income for needs (like housing), 30% for wants (like eating out), and 20% for saving or paying off debt.

- Envelope Budgeting: Split your budget into envelopes for different expenses. Put cash in each one and only spend that amount.

- Zero-Based Budgeting: Give every dollar a job, so income minus expenses equals zero.

Using these budgeting methods and organizing your money will help you see your finances clearly. You’ll be able to make better decisions to enhance your financial stability.

Financials 2: Balance Sheet

A balance sheet is key to knowing your financial status and making wise future decisions. It shows your assets, liabilities, and net worth. These are crucial for setting financial goals and growing your wealth.

Understanding your Balance Sheet

A balance sheet lists your assets, like cash and property, and your liabilities, like debts. The difference is your net worth. This gives a full view of your finances.

Asset allocation strategies are essential for wealth growth. By analyzing your assets, you can find ways to improve. This could mean diversifying investments or focusing on assets that generate income. Your balance sheet guides your decisions.

Setting Financial Goals

“A balance sheet shows your wealth’s true value and guides you to financial success.” – Megan Johnson, Financial Advisor

With a balance sheet, you can set clear financial goals. These could be buying a home, retiring early, or starting a business. It helps track your progress and adjust plans as needed.

Tracking Progress and Making Adjustments

Updating your balance sheet regularly is crucial. It lets you see how your finances change over time. You can check if your strategies for wealth and asset allocation are working. Then, make necessary changes.

Goal setting, wealth growth, and asset management are ongoing tasks. As your situation changes, so should your strategies. This ensures financial health and works toward financial independence.

Financials 3: Income Statement

The income statement is key to understanding your finances. It shows your income and expenses. This helps you manage your cash flow and make smart choices for financial freedom. I’ll show you how to make a precise income statement and use it to plan your finances well.

An income statement is a vital tool for financial planning. It displays your revenue and expenses during a certain time. By keeping track of where money comes from and goes, you can see your financial movements. This lets you make plans to improve your finances and reach your goals.

Now, let’s look at the main steps for creating an income statement:

Gather Income Information

- Collect all income sources including salary, investments, side gigs, and rental income.

- Record all income details like how often you get it, amounts before tax, and any deductions.

Track Expense Categories

- Write down your expenses like housing, utilities, transport, food, fun, and debts.

- Put each expense in its right category to track and analyze accurately.

Analyze Cash Flow

Once you categorize your income and expenses, you can study your cash flow. This shows trends, where you might be overspending, or where you could earn more.

“By closely studying your income statement, you uncover valuable insights. These help you make smart choices to achieve your financial objectives.”

Diversify Your Income Streams

Diversifying your income is crucial for financial freedom. Earning passively from investments, real estate, or other ways makes your finances more solid and lasting. It also helps you build wealth and have a stable financial base.

Take Action

Use what you learn from your income statement to create a financial plan that suits your goals. Change how you spend, look for new ways to earn, and build a lasting financial plan. This leads you to financial freedom.

Studying your income statement and earning passively are key for managing your money well. By using financial planning tools and diversifying your income, you aim for long-term financial security and a durable route to financial freedom.

Financial planning is an ongoing task. Keep reviewing and updating your income statement to stay on path to your goals. Be active, adjust to new situations, and tweak your financial methods as needed to reach your desired financial independence.

Keeping track of your expenses and managing debt are key for financial freedom. To achieve this, you need a good plan for watching your spending and handling debt. This also means building an emergency fund for safety.

Tracking Your Expenses

Understanding where your money goes is the first step to financial health. When you monitor your expenses, you pinpoint where cuts are possible to meet financial goals. There are handy tools to help you:

- Maintain a detailed budgeting spreadsheet or use budgeting apps that automatically categorize your expenses for easy tracking.

- Keep a spending diary where you jot down your daily expenses.

- Use a dedicated credit card for all your purchases and review the statements regularly to understand your spending patterns.

Staying consistent with tracking spending is crucial. Regularly checking and adjusting your budget helps you spend wisely.

Managing Your Debt

Dealing with debt wisely is crucial for financial stability and freedom. To manage debt effectively, consider these steps:

- Create a debt repayment plan: Prioritize your debts based on interest rates and payment terms, and allocate a portion of your income towards paying off high-interest debts first.

- Consider debt consolidation: If you’re juggling multiple debts, consolidating them into a single loan or credit card can simplify the repayment process and potentially reduce interest costs.

- Negotiate lower interest rates: Reach out to your lenders and explore options for lowering your interest rates, such as refinancing or negotiating for better terms.

Building an Emergency Fund

Having an emergency fund offers a financial buffer in tough times, like losing your job or facing health issues. It’s crucial to start building one right away. Here’s how:

- Set a target amount: Aim to save at least three to six months’ worth of living expenses in your emergency fund. This ensures you have enough funds to cover essential expenses in case of a financial setback.

- Automate your savings: Set up automatic transfers from your checking account to a designated emergency fund account every payday. This makes saving effortless and ensures consistent contributions.

- Save windfalls and extra income: Whenever you receive unexpected income, such as a tax refund or a bonus, allocate a portion to your emergency fund to accelerate its growth.

Building a Safety Net

Building a safety net is crucial on your journey to financial freedom. It gives you security and the ability to face unexpected problems. This way, you can chase your dreams without worry.

To create a robust financial safety net, focus on key steps:

- Emergency Fund: Begin with an emergency fund that covers 3 to 6 months of your living costs. This fund is your buffer against surprises like losing your job, health issues, or urgent home fixes. It brings peace of mind and keeps you from using your savings or falling into debt.

- Insurance Coverage: Make sure you have the right insurance for health, home, car, and life. Insurance shields you from big financial hits and prepares you for any surprise. Look around to find policies that match your needs and budget.

- Debt Management: Work on lowering debt with high interest and your total debt. Such debt can weaken your financial stability and slow down your journey to financial freedom. With a solid plan to pay off debt, you can save more money for investing and growing your wealth.

- Multiple Income Streams: Look for ways to earn beyond your main job. Consider a side business, rental properties, or earning from investments. More sources of income mean a stronger financial base and higher earnings.

Following these steps to build your financial safety net sets you up to manage life’s ups and downs. You’ll move closer to achieving your financial dreams.

Make sure you have a small emergency fund

An emergency fund is key to financial freedom. It’s your safety net for unplanned expenses. With it, you can rest easy knowing you’re covered during tough times. Let’s explore how to build one to secure your finances.

To start your emergency fund, you need a plan. These steps will help you build it:

- Set a savings goal: Figure out your target amount. Aim for three to six months’ living expenses. This creates a strong safety net for emergencies.

- Create a budget: Look at your income and spending. Find ways to save more. A budget helps you set aside money for your emergency fund.

- Automate your savings: Automate transfers to your savings account. This way, saving for emergencies is effortless.

- Build gradually: Start with small savings. Increase as you can. Every little bit helps and grows over time.

Emergency funds are for stability in unexpected times. Avoid using it for impulse buys. Keep it for real emergencies only. This fund should be separate from other savings.

Note: Experts say you should have an emergency fund even if you have debt. It acts as a financial safety net against surprises.

Maximizing your emergency fund

Once your emergency fund is set up, make it work better for you:

- Regularly review and adjust: Check if your fund still meets your needs. Change your savings goal as needed. Your fund should match your current financial situation.

- Replenish after using: If you use your fund, refill it fast. This keeps it ready for the next emergency.

- Consider a high-yield savings account: A high-interest account can grow your fund faster. This helps you reach your savings goal sooner.

Having an emergency fund is crucial for financial independence. It gives you confidence and readiness for financial surprises. Start building your fund now. It’s a big step towards financial freedom.

Pay all of your bills in full and on time

Prioritize paying bills fully and punctually for managing finances and chasing financial freedom. This crucial habit boosts your financial health and sets you up for success. Prompt payments prove you honor financial commitments, helping build a good credit score.

Responsible bill management shows lenders you’re trustworthy. This could result in better loan terms down the line. Start seeing bills as positive steps towards your goals, not burdens.

To pay bills on time, shift your money mindset. View them as key to financial stability and future well-being. This mindset shift is a proactive move towards your financial dreams.

Adopt these smart money habits to always pay bills on time:

- Plan a monthly budget to control income and outgoings. It’ll help you stay on top of bills and avoid late charges.

- Use automatic payments via your bank or with service providers. This streamlines payments, making sure you’re never late.

- Set up reminders and alerts on your devices. These will keep you organized and remind you to pay on time.

- Keeping an eye on expenses helps anticipate bills better. This way, you can set aside the right amount each month.

Paying bills on time is crucial for taking charge of your finances. It strengthens your financial foundation and opens the door to autonomy.

Regular, timely bill payments are key to financial stability. They ensure a solid credit history and good standing with creditors. This lays the groundwork for future financial opportunities and security.

Employer 401k Match

Maximizing your employer’s 401(k) match is smart for retirement savings. A 401(k) plan offers tools and resources to build a strong nest egg. It’s a key move for those planning their future retirement.

Employers often match your 401(k) contributions. This means they give you free money to boost your savings. It’s an easy way to increase your retirement funds.

Investment planning is crucial for a secure future. A 401(k) lets you diversify investments for growth. Explore options like mutual funds to match your retirement goals.

Retirement tools help you see your savings progress. Using calculators, you can estimate future savings. These insights show how much to save for your desired retirement.

Retirement advice varies for everyone. Assess your financial situation and goals. A financial advisor can offer tailored guidance for your unique needs.

Getting the most from your employer’s 401(k) match boosts your savings. Combine this with smart investment and planning tools. You’ll be well-prepared for retirement.

| Advantages of 401(k) Match | Investment Planning Strategies | Retirement Planning Tools |

|---|---|---|

|

|

|

Stop Paying Others

One key rule for financial freedom is to save and invest rather than pay others. Shift your mindset to pay yourself first. This means putting your money into savings and investments to control your financial future and grow your wealth.

Savings should balance short-term and long-term goals. Start with an emergency fund for 3 to 6 months of expenses. This fund acts as a safety net against financial surprises.

Building wealth goes beyond saving. Commit to long-term investment strategies. Spread your investments across different types like stocks, bonds, and real estate. This creates a balanced portfolio and reduces risk.

“Invest in yourself. Your career is the engine of your wealth.” – Paul Clitheroe

Wealth Creation Strategies

Creating wealth takes time and discipline. Follow these strategies to build your wealth:

- Set clear financial goals and plan to reach them. This keeps you focused, whether you’re saving for retirement or starting a business.

- Automate your savings to make it a habit. Automatic transfers to savings or investments ensure regular contributions.

- Reduce debt quickly to save and invest more. Use a debt plan to pay off high-interest debts first.

- Invest in assets that earn passive income. Examples include rental real estate and dividend stocks.

- Use tax-efficient accounts like IRAs or 401(k)s. These accounts offer tax benefits that boost your savings.

Remember, wealth creation needs patience and commitment. Keep your eyes on your goals and always look for ways to increase your savings and investments.

| Financial Independence Techniques | Benefits |

|---|---|

| Create a budget and track your expenses | Provides a clear overview of your spending habits and allows you to identify areas where you can save money. |

| Invest in education and personal development | Increases your earning potential and opens doors to new opportunities. |

| Network and collaborate with like-minded individuals | Surrounding yourself with successful people can inspire and motivate you to achieve your financial goals. |

| Continuously educate yourself about personal finance | Gives you the knowledge and confidence to make informed financial decisions. |

By using these strategies and financial independence techniques, you can control your financial future. It’s time to focus on paying yourself.

High Interest Debt pay down

Paying off high-interest debt is key for financial freedom. Credit card debt or personal loans can drain your finances. Here, I’ll share ways to clear that debt and take charge of your money.

Firstly, look closely at your debts. Check your balances, interest rates, and monthly dues. This helps you understand your financial status better.

Next, plan how you’ll repay your debts. You might like the debt snowball or avalanche method. The snowball method tackles small debts first. The avalanche method pays off the highest interest debts first. Pick the one that fits your financial goals.

My tip: Regular payments towards your high debt matter. Even small additional payments cut the interest costs and clear the debt quicker.

Consider consolidating your debt with a personal loan or a balance transfer card. This can simplify your payments and possibly offer a lower rate. Watch out for any extra costs and make sure it fits your financial plan.

While paying off your debt, don’t build up new debts. Examine your spending and find where you can save. Set a budget to focus more on paying debts and ensuring financial stability.

Achieving financial security means lowering your debt. By using smart debt management tactics, you can own your financial future. This lets you save and invest more.

| Debt Management Solutions | Benefits |

|---|---|

| Debt snowball method | Helps you stay motivated by paying off smaller debts first |

| Debt avalanche method | Focuses on paying off high-interest debts first, saving money on interest in the long run |

| Consolidation loans | Streamlines debt payments and potentially lowers interest rates |

| Balance transfer credit cards | Allows you to transfer high-interest debt to a card with a lower or 0% introductory interest rate |

Increase your emergency fund to 3 or 6 months at least

On your path to financial freedom, it’s key to start with a strong base. A crucial part of this base is having enough money set aside for emergencies. Emergency fund planning is important for your financial health and helps avoid money troubles from surprises.

Why is an emergency fund important?

An emergency fund is like a safety net. It helps you during uncertain times. Whether facing health issues, job loss, or urgent home repairs, an emergency fund reduces stress and brings peace of mind.

“An emergency fund is like having insurance against financial hardships. It gives you the ability to weather unexpected storms without derailing your progress towards financial independence.”

How much should you have in your emergency fund?

For a sturdy financial base, save 3 to 6 months of living expenses. This cushion helps in emergencies or sudden events. Figure out your monthly costs, like bills and rent, and multiply by the months you aim to cover.

Building your emergency fund:

- Automate your savings: Arrange automatic transfers to a savings account meant for emergencies. This way, you save regularly without extra effort.

- Cut back on non-essential expenses: Examine your spending and find where you can spend less. Put the saved money into your emergency fund.

- Boost your income: Try side jobs or freelance to earn more. Use this extra money to grow your emergency fund faster.

The advantages of a well-funded emergency fund:

A good emergency fund has many perks:

- Financial Stability: A fund ready for use helps you manage unexpected costs and financial hiccups without relying on loans or spending your savings.

- Peace of Mind: Having this financial cushion reduces stress and lets you focus on future goals.

- Flexibility: With an emergency fund, you can handle surprises or grab opportunities without upsetting your finances or using credit.

Work on increasing your emergency fund to at least 3 or 6 months. Doing this builds a firm financial foundation, ensuring safety and stability as you move towards financial freedom.

Mid-level debt (4-8%) pay down

Paying off mid-level debt is key to gaining financial freedom. It helps lessen your financial stress. By doing so, you set a strong foundation for your future finances. In this section, I’ll share ways to cut down mid-level debt. Plus, give tips for planning your finances long-term.

Strategies for Managing and Reducing Mid-level Debt

Handling mid-level debt, like credit cards or personal loans with 4-8% interest, needs a smart plan. Here are some smart moves:

- Debt Consolidation: Look into combining multiple debts into one. This can make payments easier and may lower interest rates.

- Balance Transfer: Moving high-interest balances to a lower rate card can help. Especially if it offers a 0% early APR, this could speed up repayment.

- Debt Snowball Method: Start by clearing the smallest debt while paying minimums on the rest. Then, use that payment for the next smallest debt. It creates momentum in debt repayment.

- Debt Avalanche Method: Or, pay off the highest interest debts first. This saves more in interest over time.

Merging these tactics with good budgeting can fast-forward your journey out of debt. This leads to financial stability.

Long-term Financial Planning for Debt Elimination

Getting rid of mid-level debt is more than just quick fixes. It’s vital to line up debt payment with a long-term plan for a debt-free future. Here are some tips:

- Track Your Expenses: Always watch your spending and find places to save. Use budget tools to make smarter money choices.

- Build an Emergency Fund: Have money set aside for surprises to avoid new debt. Try saving 3-6 months of living expenses.

- Investigate Debt Management Solutions: Feeling swamped by debt? A debt management agency might offer help to sort it out efficiently.

- Create a Long-term Financial Plan: Make a thorough financial plan. Include debt-free goals, saving, retiring, and investing. This will steer your financial decisions towards independence.

With these steps and long-term planning, beating mid-level debt is achievable. It opens the door to a financially bright future.

Next, we’ll look more into funding IRAs and diversifying investments. These are crucial for a strong retirement savings plan.

Funding IRAs

Funding Individual Retirement Arrangements (IRAs) is key to a secure financial future and strong retirement savings. IRAs offer tax advantages that help your investments grow over time. In this section, we’ll explore the different IRAs and show how to contribute effectively.

Types of IRAs

Traditional IRAs and Roth IRAs are the main types. Each offers unique benefits, so knowing the differences is essential. Let’s see which one fits your needs best.

- Traditional IRAs: Here, you contribute pre-tax dollars, which can reduce your taxable income. The money in your Traditional IRA grows tax-deferred until retirement. At retirement, withdrawals are taxed. It’s great if you expect to be in a lower tax bracket when you retire.

- Roth IRAs: Roth IRAs use after-tax dollars, so contributions aren’t tax-deductible. Yet, earnings and withdrawals can be tax-free if you meet certain conditions. Choose this if you think you’ll be in a higher tax bracket later on.

Contribution Strategies

Regular contributions to your IRA are vital for its growth. Here are strategies to help:

- Automatic Contributions: Automate savings from your bank to your IRA. This ensures steady savings and leverages dollar-cost averaging.

- Maximize Annual Contributions: Use the IRS’s annual limits. For 2021, it’s $6,000 under 50, and $7,000 for 50 or older.

- Employer Contributions: If possible, maximize employer-sponsored plans like 401(k)s before your IRA.

Investment Diversification and Wealth Preservation

Diversifying investments and using wealth preservation strategies after funding your IRA is vital. Diversification reduces risks and can enhance returns. Wealth preservation aims to protect assets over time.

“Diversification is the key to successful investing. Spreading investments across different types helps reduce market volatility impact and preserves wealth.”

Consider these strategies for IRA investment diversification:

- Asset Allocation: Spread investments across diverse asset classes based on your risk tolerance and goals.

- Rebalance Regularly: Ensure your investments match your target allocation and risk profile by rebalancing often.

- Consider Professional Help: If managing investments seems daunting, a financial advisor can tailor a strategy for you.

Securing your financial future starts with funding your IRA. Knowing IRA types, effective contribution strategies, and how to diversify investments sets the foundation for a solid retirement portfolio and a comfortable retirement.

Conclusion

My journey to financial independence has been a big success, thanks to a special flowchart. This flowchart gave me a clear path to follow. It helped me understand and manage my money better, leading me towards financial freedom.

Learning that financial independence isn’t something you achieve quickly was important. It takes a lot of commitment. By focusing on budgeting, handling debt, and investing smartly, I’ve made great progress. The flowchart was a key tool in this journey.

I’ve gained a deep understanding of what it means to be financially independent. I’ve also found amazing tools and resources. These have taught me how to budget and plan for retirement, giving me hope for my financial future.

Looking forward, I’m excited about what’s next on my financial independence path. I believe I can reach my goals and enjoy a wealthy life. I hope you’ll start your financial journey too, using the flowchart and tools I mentioned. They can help secure a bright future for you as well.

FAQ

What is the best financial independence flowchart?

What will I learn in the introduction and first steps section?

How can I get a clear picture of my financial situation?

What is the balance sheet, and how can it help me achieve my financial goals?

What is the income statement, and why is it important?

How can I effectively track my expenses and manage my debt?

What is a financial safety net, and how can I build one?

Why should I have an emergency fund?

Why is it important to pay bills on time?

How can I maximize my employer’s 401(k) match?

How can I prioritize savings and investments?

What should I do about high-interest debt?

When should I increase my emergency fund?

What should I do about mid-level debt?

Why should I fund Individual Retirement Arrangements (IRAs)?

Source Links

- https://www.plazaandmainst.com/personal-finance-flow-chart/

- https://www.reddit.com/r/financialindependence/comments/ecn2hk/fire_flow_chart_version_42/

- https://www.mrmoneymustache.com/2012/01/13/the-shockingly-simple-math-behind-early-retirement/

Money posts:

Investing Your Emergency Fund

Investing Your Emergency Fund

California Debt Relief: Legit Help or Scam? (2024)

California Debt Relief: Legit Help or Scam? (2024)

PDS Debt: Solutions for Debt Relief (2024)

PDS Debt: Solutions for Debt Relief (2024)

What’s the Difference Between Financial Freedom and Financial Independence in 2024?

What’s the Difference Between Financial Freedom and Financial Independence in 2024?

Best Debt Consolidation Loans: Clear Debt Faster (2024)

Best Debt Consolidation Loans: Clear Debt Faster (2024)

Is Credit Associates Legit? Debt Relief Explored (2024)

Is Credit Associates Legit? Debt Relief Explored (2024)

20 Ways Teens Can Prepare for Financial Independence (2024)

20 Ways Teens Can Prepare for Financial Independence (2024)

Will Millennials Be Able to Retire? (2024)

Will Millennials Be Able to Retire? (2024)