Are you looking for your Chase routing number but not sure where to find it? Don’t worry, I’m here to help. In this article, I will guide you on how to quickly locate your Chase routing number, whether you use the Chase Mobile® app, visit chase.com, or refer to your checks. Let’s get started!

Key Takeaways:

- There are multiple ways to find your Chase routing number, including using the Chase Mobile® app, visiting chase.com, or checking your checks.

- The Chase Mobile® app provides a convenient way to access your routing number on your mobile device.

- On chase.com, you can easily find your routing number by selecting the last four digits of your account number.

- Your routing number is located on the bottom of your checks, making it a physical reference for your banking transactions.

- It’s important to provide accurate account and routing numbers to ensure smooth and accurate financial transactions.

Finding Your Chase Routing Number on the Chase Mobile® App

If you’re looking for a fast and convenient way to find your Chase routing number, the Chase Mobile® app has got you covered. With just a few taps on your mobile device, you can easily access your routing number whenever you need it. Here’s how:

-

Step 1: Sign in to the Chase Mobile® app.

-

Step 2: Select your account tile.

-

Step 3: Choose “Show details” to view your bank account and routing number.

By following these simple steps, you’ll have your Chase routing number right at your fingertips, ready to use for any financial transactions you need to make.

Having the Chase Mobile® app on your mobile device gives you the freedom to manage your banking activities on the go. Whether you’re transferring funds, paying bills, or setting up direct deposit, having easy access to your routing number ensures a smooth and efficient banking experience.

Finding Your Chase Routing Number on chase.com

When it comes to locating your Chase routing number quickly and conveniently, chase.com provides a user-friendly option. To access your routing number on the chase.com website, follow these steps:

- Sign in to your Chase account on chase.com.

- Choose the last four digits of your account number, which will be displayed on the homepage.

- A box will open showing your bank account number and routing number.

This easy process allows you to access your Chase routing number with just a few clicks. Now you can confidently use the chase.com website for all your banking needs.

Why Choose chase.com for Finding Your Routing Number?

Chase.com offers a secure and convenient online platform that provides easy access to important banking information, including your routing number. By logging in to chase.com, you can quickly retrieve your routing number without the need for additional verification.

“With chase.com, finding your routing number is a breeze. Simply sign in, click on the last four digits of your account number, and voilà! Your routing number is right there.” – Chase Customer

| Benefits of Finding Your Chase Routing Number on chase.com |

|---|

| Simple and straightforward access to your routing number |

| Secure online platform for retrieving sensitive information |

| Conveniently manage your banking needs alongside access to your routing number |

Choosing chase.com for finding your Chase routing number ensures a seamless and hassle-free banking experience. With just a few clicks, you can access all the information you need for your financial transactions.

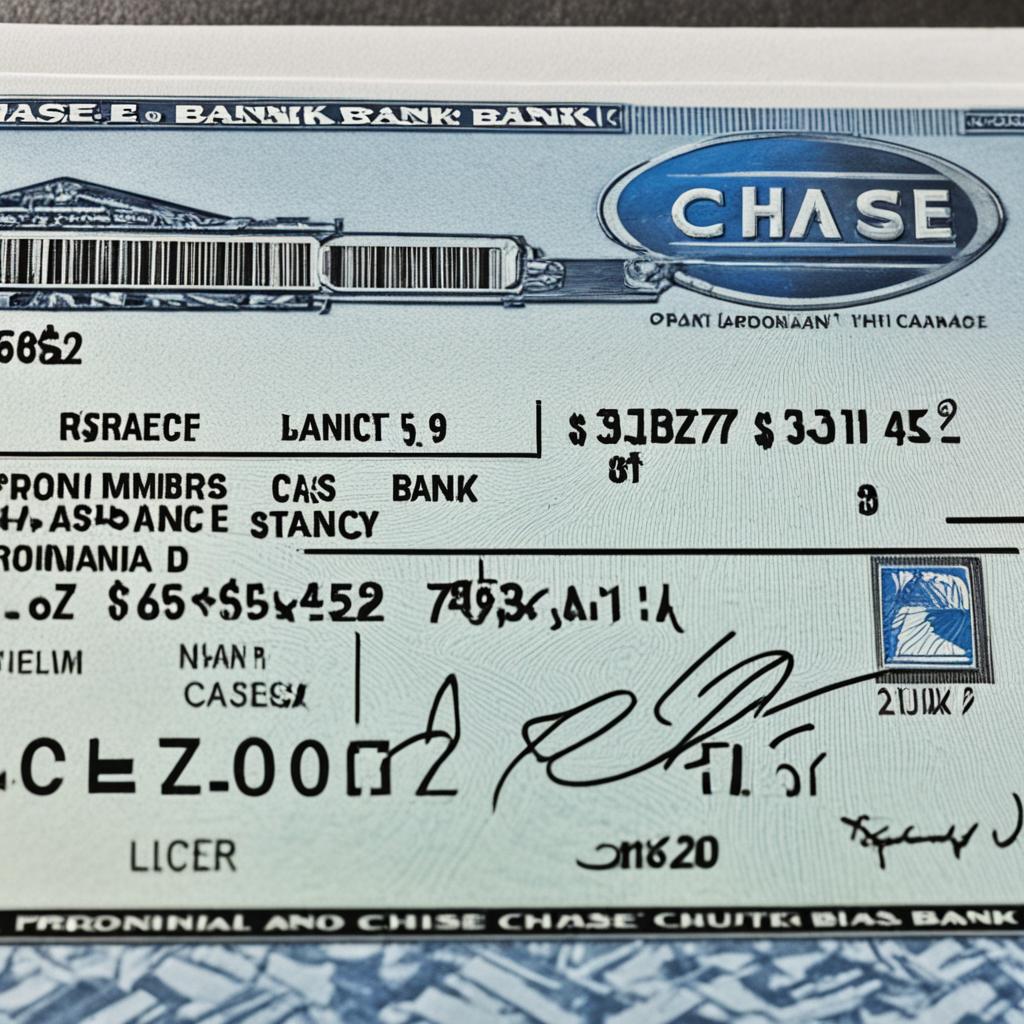

Finding Your Chase Routing Number on Your Checks

Your Chase routing number is located on the bottom of your checks. Look for the 9-digit number on the left side, which is your routing number. It is followed by your account number in the center and the check number on the right. This provides a physical reference for your routing number.

Sample Check

| Routing Number | Account Number | Check Number |

|---|---|---|

| 123456789 | *********1234 | 567 |

Understanding the Importance of Your Chase Routing Number

Your Chase routing number plays a crucial role in various financial transactions. Whether you need to set up direct deposit, transfer funds to another bank, or link your checking account to payment apps, understanding the significance of your routing number is essential for smooth and accurate banking experiences.

The Importance of Direct Deposit

Direct deposit allows you to receive your paycheck, tax refunds, or government benefits directly into your Chase account. By providing your employer or payer with your Chase routing number, you ensure that funds are deposited quickly and securely, without the need for paper checks or manual processing.

Transferring Funds to Another Bank

If you need to move money from your Chase account to another bank, your routing number is necessary to initiate the transfer. Whether you’re paying bills, sending money to family or friends, or consolidating funds, providing the correct routing number ensures that the transaction is completed accurately and efficiently.

Linking Your Checking Account to Payment Apps

In today’s digital age, payment apps offer convenience and flexibility when making purchases or sending money. To link your Chase checking account to payment apps like Venmo or PayPal, you’ll need to provide your routing number. This ensures seamless transfers and easy access to your funds whenever you need them.

By understanding the importance of your Chase routing number, you can confidently navigate various financial transactions, knowing that you have the necessary information to facilitate secure and efficient banking.

“Your Chase routing number is your gateway to hassle-free financial transactions.”

Chase Routing Numbers by State

Chase bank has multiple routing numbers that vary across different states. To ensure you have the correct routing number for your Chase account, refer to the state-specific chart provided by Chase. Each state has its own unique routing number assigned to it, so it’s important to verify the routing number that corresponds to your location and account.

| State | Routing Number |

|---|---|

| California | 322271627 |

| Texas | 111000614 |

| New York | 021000021 |

| Florida | 267084131 |

By referring to the state-specific chart, you can easily find the routing number that corresponds to your state and account. This ensures that your banking transactions are processed accurately and efficiently.

In the words of Chase bank, “We provide different routing numbers for different types of transactions to help you track them better.”

What Is a Routing Number?

A routing number, also known as an ABA number, is a 9-digit code that identifies the financial institution involved in a transaction. It is essential for processing various banking transactions, such as deposits and transfers. The routing number helps ensure that funds are directed to the correct bank.

In simple terms, a routing number acts as an address that allows money to flow securely and accurately between banks. It is like a unique identifier that distinguishes one bank from another, ensuring that transactions are processed smoothly and funds are allocated correctly.

Routing numbers are used for a variety of purposes, including:

- Direct deposits

- Receiving payments

- Electronic fund transfers

- Wire transfers

- Setting up automatic bill payments

When you provide your routing number to another party, it enables them to send money to your bank account. It is a crucial piece of information that ensures the right destination bank receives the funds.

Remember, the routing number only identifies the bank, not your specific account. To complete a transaction, both the routing number and your account number are required.

It is important to know and understand your routing number to ensure the accuracy and efficiency of your banking transactions. Now that you have a clear understanding of what a routing number is, let’s explore how to find your Chase routing number using various methods.

How to Verify Your Chase Routing Number

As a Chase customer, it is crucial to always verify that you are using the correct routing number for your specific account. Using the wrong routing number could result in delays or errors in your transactions. To ensure accuracy, follow these steps:

1. Check the State-Specific Chart

Chase provides a state-specific chart that lists the routing numbers for each state. This chart is a reliable resource to confirm the appropriate routing number for your location. Refer to the chart and locate your state to find the corresponding routing number.

2. Contact Chase Directly

If you are unable to find the routing number through the state-specific chart or have any doubts, it is best to contact Chase directly. Their customer service representatives are available to assist you and provide the accurate routing number for your account. You can reach out to the Chase customer service team through their website or by phone.

Remember, taking the time to verify your Chase routing number ensures smooth and error-free transactions. Don’t hesitate to double-check and confirm the correct routing number to avoid any potential issues.

Finding Your Routing Number for International Wire Transfers

When sending or receiving international wire transfers, the process is slightly different from domestic transactions. Instead of using a routing number, you will need to provide a SWIFT code. A SWIFT code is an international bank code that identifies financial institutions worldwide. This code ensures that the funds are accurately transferred to the intended recipient.

When receiving money from overseas, you will need to provide the SWIFT code along with other necessary information to the sender. The SWIFT code serves as a unique identifier for your bank, enabling the sender to route the funds correctly. It is essential to accurately provide the SWIFT code to avoid any delays or issues with the international wire transfer.

What is a SWIFT Code?

A SWIFT code, also known as a Bank Identifier Code (BIC), consists of a combination of letters and numbers that represent a specific bank or financial institution. It is used during international wire transfers to identify the recipient’s bank and facilitate the transfer of funds.

The SWIFT code typically comprises eight or eleven characters and is divided into sections that represent different information:

- Bank Code: The first four letters indicate the bank or financial institution.

- Country Code: The next two letters indicate the country where the bank is located.

- Location Code: The following two letters or digits represent the specific location of the bank.

- Branch Code (optional): The final three digits, if present, identify a particular branch of the bank.

Together, these characters form a unique SWIFT code that helps ensure accurate and secure international wire transfers.

Example SWIFT code format:

CHASUS33XXX

In this example, “CHAS” represents the bank, “US” indicates the United States, “33” signifies the bank’s location, and “XXX” indicates the absence of a branch code.

It is important to note that SWIFT codes may vary for different branches of a bank, so it is crucial to use the correct SWIFT code that corresponds to your specific branch or location.

By providing the SWIFT code for international wire transfers, you ensure that the funds are swiftly and accurately transferred between banks across different countries.

What to Do If You Are Confused About Your Routing Number

If you find yourself unsure about which routing number to use or if you have any confusion regarding your Chase routing number, there’s no need to worry. Chase offers excellent customer support to help you navigate through any concerns or questions you may have.

To get accurate and up-to-date information about your routing number, it is recommended to contact Chase directly. Their knowledgeable customer service representatives are there to assist you and provide the necessary guidance. They can clarify any doubts you may have and ensure that you are using the correct routing number for your specific account.

Chase’s customer service team is well-equipped to handle routing number inquiries, and they strive to offer prompt and reliable assistance. Whether you prefer to reach out to them via phone, email, or their online chat service, they are committed to providing you with the support you need.

By contacting Chase directly, you can receive the personalized assistance required to navigate any confusion surrounding your routing number, and ensure smooth banking transactions.

When to Provide Your Chase Routing Number

Knowing when to provide your Chase routing number is essential for smooth financial transactions. Here are some common scenarios where you may need to provide your routing number:

- Making Payments Online or by Phone: When making payments online or over the phone, you may be asked to provide your Chase routing number. This ensures that the funds are directed to the correct bank and account.

- Setting Up Automatic Bill Payments: If you’re setting up automatic bill payments with your Chase account, you will need to provide your routing number. This allows the billing company to initiate payments directly from your account.

- Setting Up Direct Deposit: To set up direct deposit for your paycheck or other recurring deposits, you will need to provide your routing number to your employer or income source. This ensures that the funds are deposited into your Chase account.

- Linking Your Checking Account to Payment Apps: Some payment apps require your routing number to link your Chase checking account. This allows you to transfer funds to and from the app securely.

- Making Wire Transfers: When making international or domestic wire transfers, you will need to provide your Chase routing number. This ensures that the funds are properly routed to the recipient’s bank.

Be prepared to have your Chase routing number ready when initiating these transactions. Providing the correct routing number will help facilitate seamless financial transactions and minimize any delays or errors.

Pro tip: If you’re unsure whether you need to provide your routing number, it’s always a good idea to check with the financial institution or service provider involved. They can provide specific instructions based on the nature of your transaction.

Common Scenarios Requiring Your Chase Routing Number

| Scenario | Explanation |

|---|---|

| Making Payments Online or by Phone | Ensure funds are directed to the correct bank and account. |

| Setting Up Automatic Bill Payments | Initiate recurring payments directly from your Chase account. |

| Setting Up Direct Deposit | Ensure your paycheck or other recurring deposits are deposited into your Chase account. |

| Linking Your Checking Account to Payment Apps | Securely transfer funds to and from payment apps. |

| Making Wire Transfers | Facilitate international or domestic wire transfers with accurate routing information. |

Having your Chase routing number readily available in these situations will ensure a smooth and efficient banking experience. Take note of your routing number and keep it accessible for seamless transactions.

Importance of Accurate Account and Routing Numbers

When it comes to conducting financial transactions, providing accurate account and routing numbers is of utmost importance. The smallest mistake or incorrect information can result in delays, misplaced funds, or even unauthorized access to your account. To ensure the smooth processing of your transactions, it is crucial to double-check and verify the numbers you provide.

“Accuracy is the key to successful financial transactions. Don’t let a simple error disrupt your banking experience.”

Whether you’re setting up direct deposit, making online payments, or initiating wire transfers, accurate account and routing numbers lay the foundation for a seamless experience. These numbers act as unique identifiers that connect your bank account to the correct financial institution and help facilitate secure and efficient transactions.

By diligently confirming your account and routing numbers, you reduce the chances of encountering problems such as returned payments, delayed deposits, or even identity theft. Taking a few extra seconds to verify these essential details can save you from potential headaches down the line.

It’s worth noting that ensuring accuracy goes beyond simply providing the correct numbers. It also involves updating your information promptly whenever necessary. If you’ve recently changed banks, closed an account, or obtained a new routing number, make sure to inform relevant parties promptly to avoid any complications.

Remember: Accuracy is the cornerstone of successful financial transactions. Take the necessary steps to confirm your account and routing numbers and safeguard your banking activities.

Why Accuracy Matters:

- Mistakes can lead to delays in processing payments and deposits.

- Incorrect information may result in funds being deposited into the wrong account.

- Providing inaccurate numbers could leave you vulnerable to fraud or unauthorized access.

Don’t underestimate the impact of accurate account and routing numbers. They ensure the smooth flow of funds and help protect your financial well-being. Maintain vigilance when handling these crucial details, and enjoy peace of mind in your banking transactions.

Safeguarding Your Account and Routing Numbers

Your account and routing numbers should always be treated as sensitive information. To ensure the security of your financial transactions, it’s crucial to follow best practices when sharing this information.

Only Provide Information to Trusted Parties

When sharing your account and routing numbers, make sure you are providing them to trusted parties or secure platforms that require this information for legitimate purposes. Avoid sharing this information with unknown individuals or unverified websites to minimize the risk of unauthorized access or potential fraud.

Protect Yourself from Phishing Attempts

Be cautious of phishing attempts, where malicious individuals may try to trick you into revealing your account and routing numbers through fraudulent emails or websites. Always double-check the website’s URL, ensure it’s secure (look for “https://”), and never provide your financial information unless you are certain of its legitimacy.

“Always remember, your bank will never ask you to share your account and routing numbers via email or text messages. If you receive any suspicious requests, report them to your bank immediately.”

Keep Your Information Secure

Prevent unauthorized access to your account and routing numbers by keeping your information secure. Use secure passwords for your online banking accounts and never share them with anyone. Additionally, avoid saving sensitive information on shared or public devices to minimize the risk of exposure.

Monitor Your Accounts Regularly

Stay vigilant by monitoring your accounts regularly for any unauthorized transactions or suspicious activity. If you notice any unusual activity, contact your bank immediately to report it. Taking proactive measures to protect your accounts can help prevent potential losses and ensure the safety of your financial information.

By following these guidelines, you can safeguard your account and routing numbers, ensuring the security of your financial information. Remember, protecting your personal information is essential in today’s digital age, and taking proactive steps to secure your accounts is crucial for a safe banking experience.

Conclusion

Finding your Chase routing number fast is crucial for seamless banking transactions. Whether you prefer the convenience of the Chase Mobile® app, the ease of chase.com, or the physical reference of your checks, having access to your routing number allows you to effortlessly complete various financial tasks. Remember to always verify the routing number for your specific account and ensure the confidentiality of your account and routing numbers.

By using the Chase Mobile® app, you can quickly locate your routing number by signing in and selecting your account tile. On chase.com, simply choose the last four digits of your account number to view your bank account and routing number. Additionally, your routing number can be found on the bottom of your checks, with the 9-digit number on the left side.

Understanding the importance of your Chase routing number is essential for direct deposit, fund transfers, and linking your checking account to payment apps. By accurately providing your routing number, you avoid delays, errors, and unauthorized access to your account. Remember to safeguard your account and routing numbers, only sharing them with trusted parties and secure platforms.

FAQ

How can I find my Chase routing number quickly?

To quickly locate your Chase routing number, you can use the Chase Mobile® app, visit chase.com, or refer to your checks.

How do I find my Chase routing number on the Chase Mobile® app?

To find your Chase routing number on the Chase Mobile® app, sign in and select your account tile. Then, choose “Show details” to see your bank account and routing number.

How do I find my Chase routing number on chase.com?

To find your Chase routing number on chase.com, sign in and choose the last four digits of your account number. A box will open displaying your bank account number and routing number.

Where can I find my Chase routing number on my checks?

Your Chase routing number is located on the bottom of your checks. Look for the 9-digit number on the left side, which is your routing number.

Why is my Chase routing number important?

Your Chase routing number is important for various financial transactions, including direct deposit, transferring funds to another bank, and linking your checking account to payment apps.

Does Chase have different routing numbers for different states?

Yes, Chase has multiple routing numbers across different states. Refer to the state-specific chart provided by Chase to find your specific routing number.

What is a routing number?

A routing number, also known as an ABA number, is a 9-digit code that identifies the financial institution involved in a transaction.

How can I verify my Chase routing number?

Verify your Chase routing number by checking the state-specific chart provided by Chase or contacting Chase directly.

What routing number do I need for international wire transfers?

For international wire transfers, you will need a SWIFT code instead of a routing number.

What should I do if I am confused about my routing number?

If you are confused about your routing number, it is recommended to contact Chase directly for accurate and up-to-date information.

When do I need to provide my Chase routing number?

Your Chase routing number may be required for various financial transactions, including online payments, setting up direct deposit, and making wire transfers.

How important is it to provide accurate account and routing numbers?

Providing accurate account and routing numbers is crucial to ensure the smooth processing of financial transactions and prevent delays or errors.

How should I safeguard my account and routing numbers?

Treat your account and routing numbers as sensitive information and only provide them to trusted parties or secure platforms. Safeguarding this information helps prevent unauthorized access and potential fraud.

Our Friends

- https://www.chase.com/digital/customer-service/helpful-tips/personal-banking/mobile/account-routing-numbers

- https://www.chase.com/personal/checking/routing-numbers

- https://www.gobankingrates.com/banking/banks/chase-routing-number/

Money posts:

Chase Bank Promotions & Bonus Offers for September 2024

Chase Bank Promotions & Bonus Offers for September 2024

Chase Bank Review (2024)

Chase Bank Review (2024)

Chase Business Checking Promotion | $300 Bonus Offer (2024)

Chase Business Checking Promotion | $300 Bonus Offer (2024)

9 Best Mobile Banking Apps for 2024 – Manage Your Money on the Go

9 Best Mobile Banking Apps for 2024 – Manage Your Money on the Go

Axos Bank Review | Millennial Money (2024)

Axos Bank Review | Millennial Money (2024)

CIT Bank Promotions | Up to $300 for Opening A Savings Account

CIT Bank Promotions | Up to $300 for Opening A Savings Account

Opening an Online Bank Account: What You Need to Know (2024)

Opening an Online Bank Account: What You Need to Know (2024)

12 Best Banks For Self-Employed Freelancers & Side Hustlers (2024)

12 Best Banks For Self-Employed Freelancers & Side Hustlers (2024)